Peer Review Process

Peer-Review Process

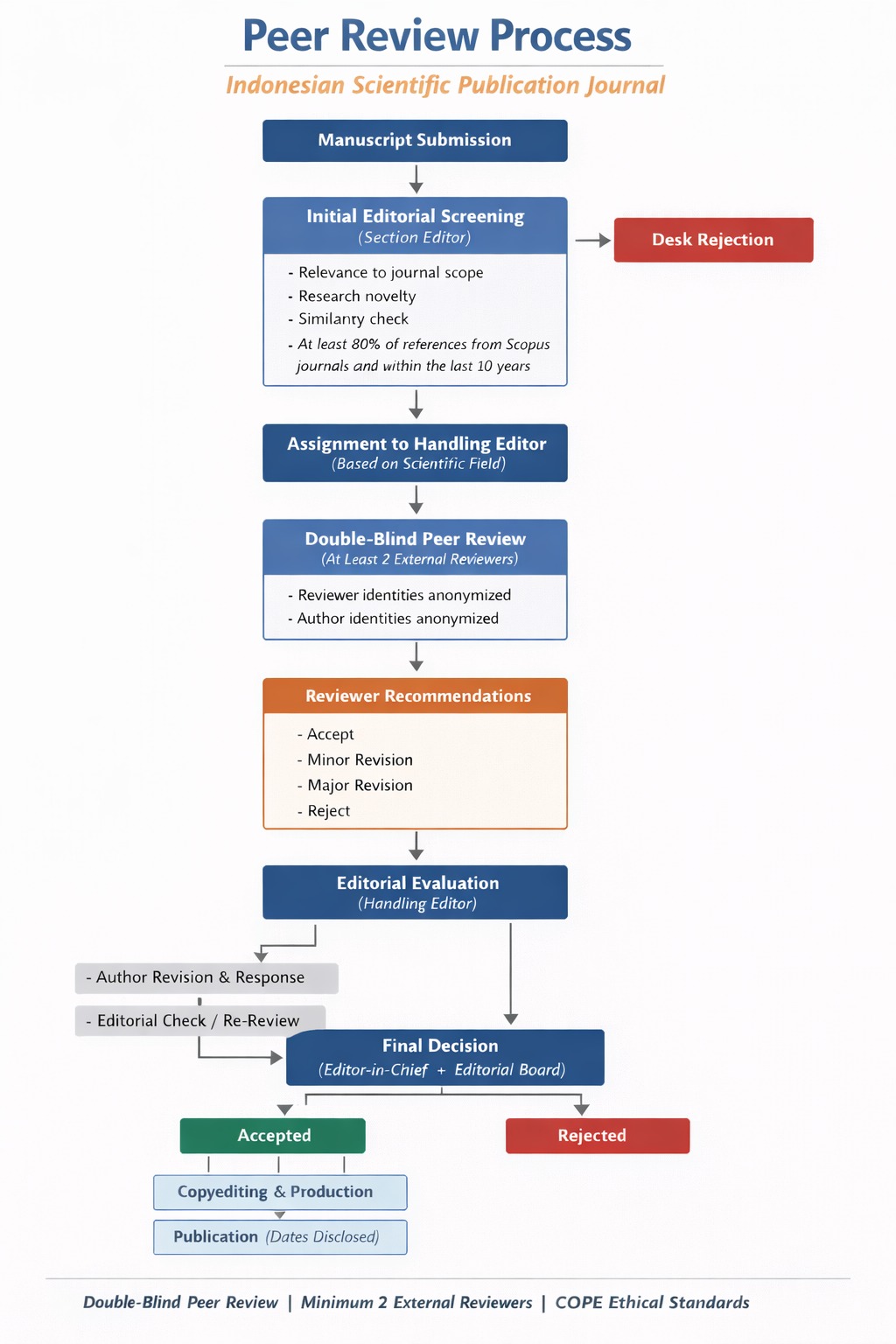

Summa: Journal of Accounting and Tax follows a rigorous and transparent review process to ensure the quality and credibility of the published articles. The journal adopts a double-blind (double-anonymous) peer-review type, where the identities of both the authors and reviewers are kept anonymous during the review process.

Submission and Initial Evaluation

All manuscripts submitted to Summa: Journal of Accounting and Tax undergo an initial evaluation by the editorial team to assess their suitability and compliance with the journal's scope and guidelines. Manuscripts that pass the initial evaluation are assigned a unique identification number for further processing.

- A newly submitted manuscript will be screened by the Editor-in-Chief to ensure its conformity with the journal’s scope and basic submission requirements. The Editor-in-Chief will assign the manuscript to an appropriate handling editor based on the scientific field of the article.

Peer Review

Each eligible manuscript is then sent for review to a minimum of two independent expert reviewers in the relevant field. Reviewers are carefully selected based on their expertise, experience, and prior contributions to the field.

- Manuscripts that pass the initial screening are sent to at least two subject matter experts for a double-blind peer review. In cases where reviewer opinions differ significantly, an additional reviewer may be invited to ensure a comprehensive evaluation.

Double-Blind Review

Summa: Journal of Accounting and Tax ensures a double-blind (double-anonymous) peer-review process, where the identities of both the authors and reviewers are concealed from each other. This helps maintain objectivity and fairness in the evaluation process, minimizing potential biases.

Review Criteria

Reviewers are requested to assess the submitted manuscripts based on their scientific quality, originality, relevance to the journal's scope, clarity of presentation, and adherence to ethical guidelines. Constructive feedback and suggestions for improvement are encouraged to assist the authors in enhancing the quality of their work.

Review Duration

Summa: Journal of Accounting and Tax strives to provide timely and efficient peer review. Reviewers are typically given a specific timeframe to complete their evaluations. Authors will be informed of the review process's estimated duration during the initial submission or after any significant revisions.

- Authors whose manuscripts require revisions are given up to three weeks to address the reviewers' comments and submit a revised version.

Decision and Revision

Upon completion of the peer review process, the editorial team considers the reviewers' comments and recommendations. Authors will receive a decision, which may include acceptance, minor or major revisions, or rejection.

- The editorial team evaluates the revised manuscript to ensure that all reviewer comments have been adequately addressed. If revisions are deemed insufficient, the manuscript will be returned to the authors for further modification.

Editorial Decision

The final decision regarding the publication of a manuscript rests with the Editor-in-Chief or the Editorial Board members. The editorial team carefully considers the reviewers' assessments, the originality of the work, the relevance to the journal's scope, and adherence to ethical standards before making a final decision.

- The possible outcomes include rejection, acceptance with minor or major revisions, or a recommendation for resubmission if substantial changes are needed.

Confidentiality

Summa: Journal of Accounting and Tax maintains strict confidentiality of the peer review process. Reviewers are required to treat the manuscripts and their contents as confidential documents and should not disclose any information to unauthorized individuals.

Review Process Improvement

Summa: Journal of Accounting and Tax continuously seeks to improve its review process. Authors and reviewers' feedback are invaluable in this endeavor. The journal welcomes constructive feedback and suggestions to enhance the efficiency and fairness of the review process.

Contact

For any inquiries or questions related to the review process, please contact the editorial team at [email protected]